Rice County Minnesota Property Taxes . Web online access to maps, real estate data, tax information, and appraisal data. Web the median property tax (also known as real estate tax) in rice county is $1,868.00 per year, based on a median home value of. Web taxes that total $100 or less for the year and mobile home property taxes that total $50 or less for the year must be paid in full on. Web estimated market value (emv) is one of the factors used to determine your property taxes. It represents the normal sale price. Web the minnesota department of revenue provides resources relating to property tax and property tax administration. Calculates rates and extends property taxes. Prepares and distributes property tax and mobile home. Penalties for late payment of.

from lakesnwoods.com

Calculates rates and extends property taxes. Web estimated market value (emv) is one of the factors used to determine your property taxes. Web online access to maps, real estate data, tax information, and appraisal data. Web the minnesota department of revenue provides resources relating to property tax and property tax administration. Web the median property tax (also known as real estate tax) in rice county is $1,868.00 per year, based on a median home value of. It represents the normal sale price. Prepares and distributes property tax and mobile home. Penalties for late payment of. Web taxes that total $100 or less for the year and mobile home property taxes that total $50 or less for the year must be paid in full on.

Rice County Minnesota Guide

Rice County Minnesota Property Taxes Web online access to maps, real estate data, tax information, and appraisal data. It represents the normal sale price. Calculates rates and extends property taxes. Web taxes that total $100 or less for the year and mobile home property taxes that total $50 or less for the year must be paid in full on. Web the minnesota department of revenue provides resources relating to property tax and property tax administration. Prepares and distributes property tax and mobile home. Web online access to maps, real estate data, tax information, and appraisal data. Penalties for late payment of. Web the median property tax (also known as real estate tax) in rice county is $1,868.00 per year, based on a median home value of. Web estimated market value (emv) is one of the factors used to determine your property taxes.

From www.ricecountymn.gov

Pay property taxes Rice County, MN Rice County Minnesota Property Taxes Calculates rates and extends property taxes. Web the median property tax (also known as real estate tax) in rice county is $1,868.00 per year, based on a median home value of. Prepares and distributes property tax and mobile home. It represents the normal sale price. Web estimated market value (emv) is one of the factors used to determine your property. Rice County Minnesota Property Taxes.

From kdhlradio.com

Rice County Commissioners Adopt Redistricting Rice County Minnesota Property Taxes Web online access to maps, real estate data, tax information, and appraisal data. It represents the normal sale price. Web taxes that total $100 or less for the year and mobile home property taxes that total $50 or less for the year must be paid in full on. Web the minnesota department of revenue provides resources relating to property tax. Rice County Minnesota Property Taxes.

From www.lakesnwoods.com

Guide to Rice Minnesota Rice County Minnesota Property Taxes Web online access to maps, real estate data, tax information, and appraisal data. Prepares and distributes property tax and mobile home. Calculates rates and extends property taxes. Penalties for late payment of. Web taxes that total $100 or less for the year and mobile home property taxes that total $50 or less for the year must be paid in full. Rice County Minnesota Property Taxes.

From co.rice.mn.us

Rice County, MN Official Website Rice County Minnesota Property Taxes Calculates rates and extends property taxes. It represents the normal sale price. Penalties for late payment of. Web estimated market value (emv) is one of the factors used to determine your property taxes. Web the minnesota department of revenue provides resources relating to property tax and property tax administration. Prepares and distributes property tax and mobile home. Web online access. Rice County Minnesota Property Taxes.

From www.landwatch.com

Faribault, Rice County, MN Lakefront Property, Waterfront Property Rice County Minnesota Property Taxes It represents the normal sale price. Web the minnesota department of revenue provides resources relating to property tax and property tax administration. Web the median property tax (also known as real estate tax) in rice county is $1,868.00 per year, based on a median home value of. Calculates rates and extends property taxes. Web estimated market value (emv) is one. Rice County Minnesota Property Taxes.

From patch.com

Rice County Property Taxes Up; Residents Paying Sooner as Deadline Rice County Minnesota Property Taxes Web online access to maps, real estate data, tax information, and appraisal data. Web the minnesota department of revenue provides resources relating to property tax and property tax administration. Web taxes that total $100 or less for the year and mobile home property taxes that total $50 or less for the year must be paid in full on. Web estimated. Rice County Minnesota Property Taxes.

From www.mapsofworld.com

Rice County Map, Minnesota Rice County Minnesota Property Taxes It represents the normal sale price. Web online access to maps, real estate data, tax information, and appraisal data. Penalties for late payment of. Prepares and distributes property tax and mobile home. Web the median property tax (also known as real estate tax) in rice county is $1,868.00 per year, based on a median home value of. Web the minnesota. Rice County Minnesota Property Taxes.

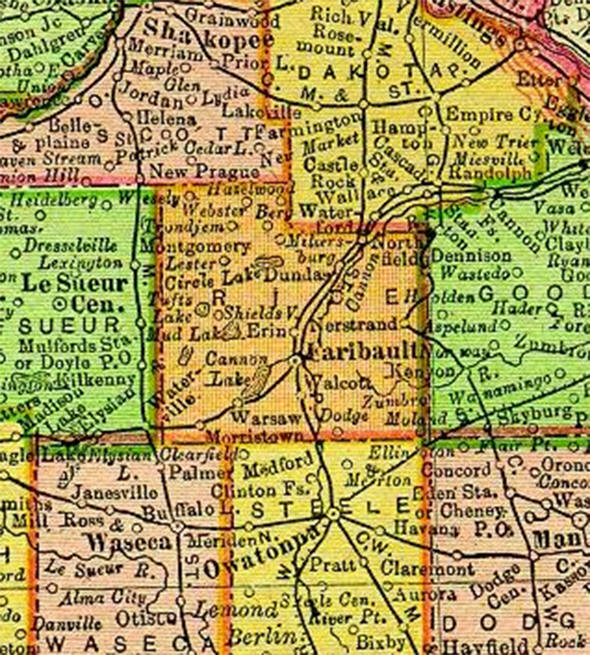

From migenweb.org

1876 Cannon Township Plat Map Rice County Minnesota Property Taxes Calculates rates and extends property taxes. Web the minnesota department of revenue provides resources relating to property tax and property tax administration. Web online access to maps, real estate data, tax information, and appraisal data. It represents the normal sale price. Prepares and distributes property tax and mobile home. Penalties for late payment of. Web the median property tax (also. Rice County Minnesota Property Taxes.

From rockfordmap.com

Minnesota Olmsted County Plat Map & GIS Rockford Map Publishers Rice County Minnesota Property Taxes It represents the normal sale price. Web online access to maps, real estate data, tax information, and appraisal data. Web the minnesota department of revenue provides resources relating to property tax and property tax administration. Web the median property tax (also known as real estate tax) in rice county is $1,868.00 per year, based on a median home value of.. Rice County Minnesota Property Taxes.

From www.ricecountymn.gov

Property Taxes Rice County, MN Rice County Minnesota Property Taxes Web online access to maps, real estate data, tax information, and appraisal data. Web estimated market value (emv) is one of the factors used to determine your property taxes. Web taxes that total $100 or less for the year and mobile home property taxes that total $50 or less for the year must be paid in full on. Web the. Rice County Minnesota Property Taxes.

From www.landwatch.com

Northfield, Rice County, MN House for sale Property ID 338304719 Rice County Minnesota Property Taxes Prepares and distributes property tax and mobile home. Web estimated market value (emv) is one of the factors used to determine your property taxes. Web taxes that total $100 or less for the year and mobile home property taxes that total $50 or less for the year must be paid in full on. Web online access to maps, real estate. Rice County Minnesota Property Taxes.

From nrcdighistory.org

Maps NorthfieldRice County Digital History Collection Rice County Minnesota Property Taxes Calculates rates and extends property taxes. Web estimated market value (emv) is one of the factors used to determine your property taxes. Web the median property tax (also known as real estate tax) in rice county is $1,868.00 per year, based on a median home value of. Web online access to maps, real estate data, tax information, and appraisal data.. Rice County Minnesota Property Taxes.

From www.landsalesbulletin.com

Land Sales Bulletin Accurate and timely land sales data Rice County Minnesota Property Taxes It represents the normal sale price. Penalties for late payment of. Web taxes that total $100 or less for the year and mobile home property taxes that total $50 or less for the year must be paid in full on. Web the minnesota department of revenue provides resources relating to property tax and property tax administration. Prepares and distributes property. Rice County Minnesota Property Taxes.

From lakesnwoods.com

Rice County Minnesota Guide Rice County Minnesota Property Taxes Web the median property tax (also known as real estate tax) in rice county is $1,868.00 per year, based on a median home value of. Web estimated market value (emv) is one of the factors used to determine your property taxes. Calculates rates and extends property taxes. Penalties for late payment of. It represents the normal sale price. Web taxes. Rice County Minnesota Property Taxes.

From www.niche.com

2021 Best Places to Raise a Family in Rice County, MN Niche Rice County Minnesota Property Taxes Web the median property tax (also known as real estate tax) in rice county is $1,868.00 per year, based on a median home value of. Penalties for late payment of. It represents the normal sale price. Web online access to maps, real estate data, tax information, and appraisal data. Web estimated market value (emv) is one of the factors used. Rice County Minnesota Property Taxes.

From www.southernminn.com

Rice County in the top 25 percent of Minnesota's healthiest counties Rice County Minnesota Property Taxes Web estimated market value (emv) is one of the factors used to determine your property taxes. Web the minnesota department of revenue provides resources relating to property tax and property tax administration. It represents the normal sale price. Web online access to maps, real estate data, tax information, and appraisal data. Calculates rates and extends property taxes. Penalties for late. Rice County Minnesota Property Taxes.

From www.dot.state.mn.us

Rice County Maps Rice County Minnesota Property Taxes Penalties for late payment of. Prepares and distributes property tax and mobile home. Calculates rates and extends property taxes. Web taxes that total $100 or less for the year and mobile home property taxes that total $50 or less for the year must be paid in full on. Web the median property tax (also known as real estate tax) in. Rice County Minnesota Property Taxes.

From diaocthongthai.com

Map of Rice County, Minnesota Địa Ốc Thông Thái Rice County Minnesota Property Taxes Web the minnesota department of revenue provides resources relating to property tax and property tax administration. Web taxes that total $100 or less for the year and mobile home property taxes that total $50 or less for the year must be paid in full on. Prepares and distributes property tax and mobile home. Penalties for late payment of. Web the. Rice County Minnesota Property Taxes.